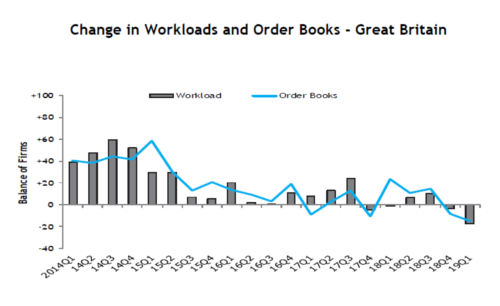

Infrastructure contractors have seen workloads slow at a faster pace than at any point since the last recession, according to a new poll.

Redevelopment of the seafront in Porthcawl, Wales

The results of the Civil Engineering Contractors Association (CECA) Workload Trends Surveys across the last six months show plummeting workload figures, with delays to major projects cited as a key concern.

According to CECA, which represents companies that undertake more than 80% of infrastructure construction in the UK, the figures covering Q4 2018 and Q1 2019 showed the largest decline since 2012.

Workloads fell for a second consecutive quarter in Q1, according to 17% of British firms, on balance.

- Seven out of 10 sectors reported falling workloads, on balance, with electricity recording the weakest balance since 2010 (-46%).

- Order books decreased for 15% of firms, on balance, and only 6% expected an increase in workloads during the next 12 months.

- Costs were reported to have increased for 91% of firms, in Q1, the highest balance on record.

Projects including HS2, rail electrifications and upgrades to the country’s motorways, as well as smaller regeneration schemes, seem to be held up, with CECA suggesting that uncertainty over Brexit could be the reason.

Image from CECA

CECA chief executive Alasdair Reisner said: 'Our worry is that the Government’s public commitment to infrastructure is crumbling behind the scenes, with other political priorities meaning that this vital driver for growth and social wellbeing is being sidelined.

'The seemingly never-ending uncertainty regarding the UK’s future relationship with the European Union is having a clear and unambiguous effect on business confidence.

'At a time when the UK Government should be ensuring the infrastructure sector is driving growth in the economy, all we are seeing is delay upon delay to schemes, and prevarication when it comes to future investment.

'We call on the Government to take concrete steps to reverse this downward trend, by getting on with the delivery of projects that it has already publicly committed to deliver, unlocking jobs and growth across the country.'

The UK Government has promoted a pipeline of more than £600bn of investment in more than 700 projects nationwide.

Workload by type of work

The sector that reported the weakest balance in workloads in Q1 was electricity, with 46% of firms reporting a decline. This was the lowest balance in nine years.

- Airports (-37%),

- Local roads (-27%) marking the 15th consecutive quarter of decline

- Railways (-20%) remained negative in Q1. For local roads, .

- Water and sewerage (-19%)

- Airports (-37%) also reported negative balances for a third consecutive quarter in Q1.

Three sectors experienced increases in workloads, on balance, in Q1.

- Communications (54%),

- Gas (6%)

- Motorways/trunk roads (2%)

All three reported positive balances in Q1.

Order books

Eight sectors reported a decrease in orders compared to 12 months ago, on balance.

- Airports (-59%) the lowest since 2010 Q2

- electricity (-45%) the joint lowest on record

- water and sewerage (-22%),

- preliminary works (-18%), and

- gas (-7%) all remained negative in Q1.

Two sectors reported an increase in orders compared to 12 months ago, on balance.

- Communications (7%) -positive for a second quarter

- motorways/trunk roads 4%

Future trends

On balance, only 6% of firms in Great Britain reported that workloads are expected to increase in the next 12 months, up marginally from 4% in 2018 Q4.

In England, this figure was 17%, in Wales 5% and in Scotland, expectations deteriorated for a fourth consecutive quarter, with 21% of the respondents expecting a fall in workloads over the next 12 months.

Register now for full access

Register just once to get unrestricted, real-time coverage of the issues and challenges facing UK transport and highways engineers.

Full website content includes the latest news, exclusive commentary from leading industry figures and detailed topical analysis of the highways, transportation, environment and place-shaping sectors.

Use the link below to register your details for full, free access.

Already a registered? Login